Article Licenses: CA, DL, unknown, unknown, unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

Some people never pay themselves first.

After most people have paid for their necessities, there seems to be little left over for investing.

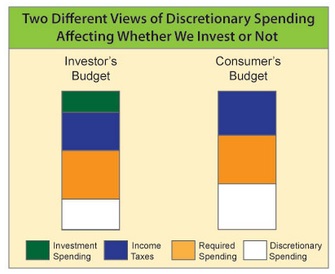

Determine your perspective on investing. Always spending and never investing is a serious dilemma often based on a certain mindset that can easily change for the better. Do you view yourself as a consumer or an investor?

Determine your perspective on investing. Always spending and never investing is a serious dilemma often based on a certain mindset that can easily change for the better. Do you view yourself as a consumer or an investor?

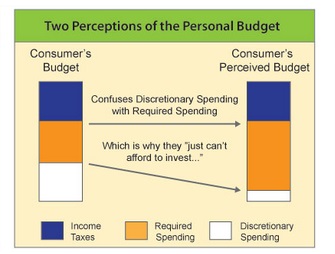

If you see yourself as a “consumer”, you may experience that there is never enough paycheck left at the end of the month for investing. However, is this caused by a lack of income or your own spending patterns? The first barrier to investing is a “perceived lack” of investment capital, often not reflecting reality. Unfortunately, what we think often becomes our reality.

Investors have personal discipline Conversely, “Investors” take an honest mathematical look at their expenses, separating discretionary income from what one needs to live on, knowing that impulsive buying decisions, even to purchase many small things on sale can add up.

This disciplined viewpoint allows them to have money to invest. Once paid, the first “consumption” decision can be to purchase an investment suitable to their goals and objectives. The rest of their paycheck is then spent with no worries on required consumption for the rest of the month.

Investors get good advice, and then act. Many people are impatient or confused when it comes to the science of investing. True “Investors” all have a key characteristic that makes for success — taking the right action with professional advisory assistance. They also understand that without experience and knowledge, investments decisions can be made in haste, and potentially destroy an otherwise good investment plan.

All articles are a legal copyright of Adviceon®Media.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This website is not deemed to be used as a solicitation in a jurisdiction where this representative is not registered. This content is not intended to provide specific personalized advice, including, without limitation, investment, insurance, financial, legal, accounting or tax advice; and any reference to facts and data provided are from various sources believed to be reliable, but we cannot guarantee they are complete or accurate; and it is intended primarily for Canadian residents only, and the information contained herein is subject to change without notice. References in this Web site to third party goods or services should not be regarded as an endorsement, offer or solicitation of these or any goods or services. Always consult an appropriate professional regarding your particular circumstances before making any financial decision.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investment funds, including segregated fund investments. Please read the fund summary information folder prospectus before investing. Mutual Funds and/or Segregated Funds may not be guaranteed, their market value changes daily and past performance is not indicative of future results. The publisher does not guarantee the accuracy and will not be held liable in any way for any error, or omission, or any financial decision. Talk to your advisor before making any financial decision. A description of the key features of the applicable individual variable annuity contract or segregated fund is contained in the Information Folder. Any amount that is allocated to a segregated fund is invested at the risk of the contract holder and may increase or decrease in value. Product features are subject to change.