Some people never pay themselves first. After most people have paid for their necessities, there seems to be little left for investing. This dilemma is often based on a certain mindset. Procrastination can be complicated by rising costs due to inflation, which may shrink disposable income.

Are you a Consumer or an Investor?

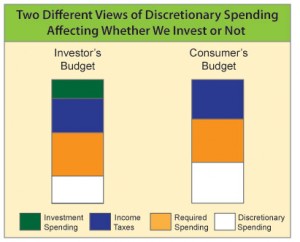

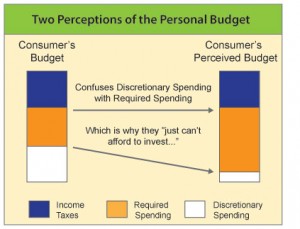

As a “Consumer”, one can find a common problem: there is never enough paycheck left at the end of the month for investing. However, is this a question of income or spending patterns? The first barrier to investing is a “perceived lack” of investment capital, often not reflecting reality. Unfortunately, what we think becomes our reality. During inflation, for example, people generally pare back unnecessary expenditures.

Conversely, “Investors” take an honest mathematical look at their expenses, separating discretionary income from what one needs to live on, knowing those impulsive buying decisions, even purchasing many small things on sale, can add up. This disciplined view allows them to have money to invest. They make every opportunity to invest in themselves first with strategic investment goals. Once paid, their first “consumption” would be an investment decision suitable to their goals and objectives. The rest of their paycheck is then spent without worries on required consumption for the rest of the month.

Investors get good advice and then act.

Many people are impatient or confused when it comes to the science of investing. “What does it mean to be a successful investor?” If an individual doesn’t understand the answer to this query, they may never proceed to invest for retirement or any worthy goal needing significant amounts of money saved. Actual “Investors” all have a crucial characteristic that makes for success—taking the right action with professional advisory assistance. They also understand that without experience and knowledge, investment decisions can be made in haste, potentially destroying an otherwise sound investment plan.